It's in the CORE !

END-TO-END INSURANCE CORE-TECH SOLUTIONS

INSURANCE DIGITAL SOLUTIONS

ALL IN ONE

One Platform

Comprehensive management of an insurance company by one digital platform

Short time to market

Launch insurance products quickly and adapt to advanced technologies

Compliance Regulations

Compliance with PCI-DSS Multiple regulatory jurisdiction

Scalable Architecture

Easy and flexible integration for multiple systems of all types

Innovative customer experience

Digitizing customer experience in all channels

Legacy Modernization

Modernization of current legacy platform with digital layers

Manage all insurance activities through a single innovative platform

MODULES

DECISION MANAGEMENT

Fast and efficient decision-making between different alternatives in real time. Insurance professionals can for the first time, make decisions entirely digitally

Learn More

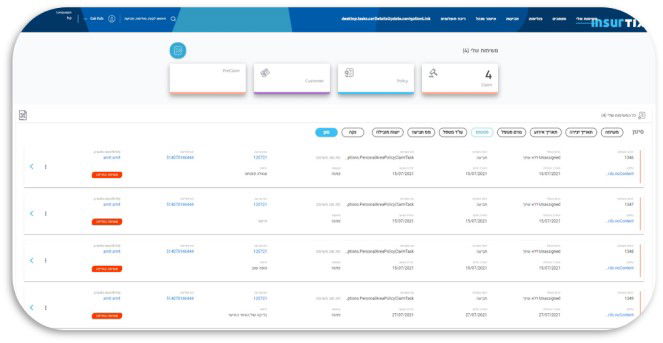

POLICY MANAGEMENT

Manage and support digitally all life of multi policy, from bids, production, policy changes, cancellation or renewal

Learn MorePRODUCT MANAGEMENT

Define and manage products easily from different fields in the same marketing and administrative sales process. Calculate multiple policies in real time

Learn MoreUNDERWRITING

Advanced Rules engine with fully automated process and external sources integration

Learn More

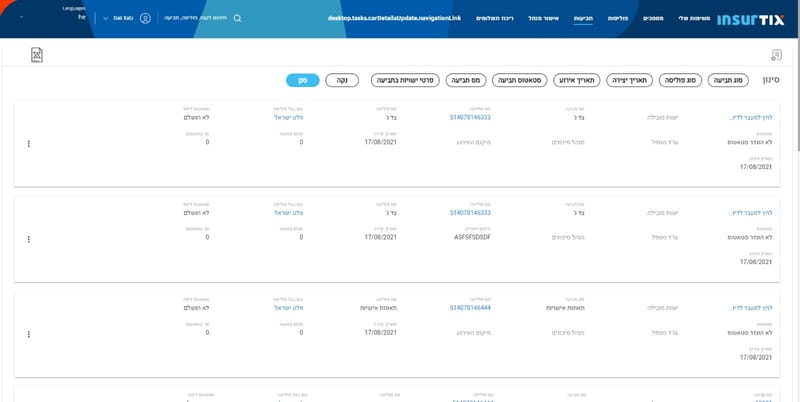

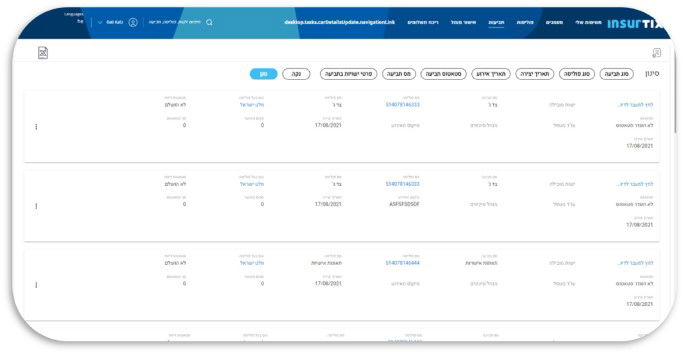

CLAIMS

A sophisticated rules engine allows clearing claims automatically or make quick and efficient decisions concerning them

Learn MoreFINANCIAL MANAGEMENT

Advanced financial management system of all charges and customer payments by products and activities by time line

Learn MoreREINSURANCE

The reinsurer module supports different types of contracts of one or more reinsurers and covers all types of insurance products .

Learn More